There's nothing wrong with spending money on our loved ones at Christmas. However, some of us can get caught up in serious debt.

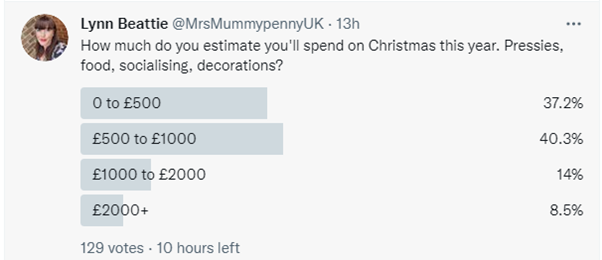

How much do we normally spend? I asked my Twitter audience about what their intended spend was last Christmas.

77% of the people who answered the poll planned to spend £1000 or less. But 14% are spending between £1000-£2000 and then 9% spending more than £2000.

Some of us spend significant sums, but no matter your budget, there are likely areas where you can save.

I'm not here to tell you how to spend your money, but by following our advice, you can stash some funds away this festive season without sacrificing good times and memories.

Don't worry if you feel like you aren't saving enough. Everyone's expenses, income and priorities are different, so don't feel anxious about how much you put away - something is better than nothing.

How to avoid Christmas debt

Make a budget

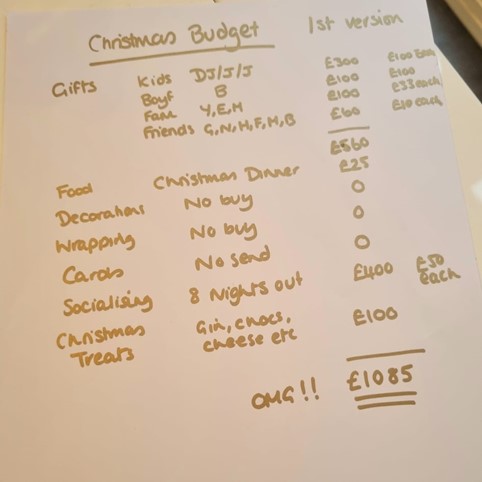

I have previously written about keeping a spending diary and how to create a budget, which is relevant at Christmas. It's difficult to save money without a budget.

We've broken down making a budget into three steps.

Refine your gift list

For a first step, have a good think about your gift list; you'll usually want to buy for your children, family and close friends.

Sometimes, we can buy gifts for people who may not want them. Is there anyone you're buying for this year that may not want a gift?

Talk to people if you aren't going to buy them something. You'll be surprised how many people are grateful for this conversation, and they'll usually respond well.

Besides, people typically want you to spend time, not money, with them at Christmas.

Make a food budget

The second step is food.

Be sure to include all the Christmas costs for not just Christmas dinner, but also those extra treats and social events. How many Christmas nights out/mince pie catch-ups do you have planned?

Once you have your first version of the budget, rationalise it. Do you need to spend all that money on nights out? Do you need £50 for extra chocolates and gin?

Buy from the right places

The budget is all about refining what you need and then finding the best places to buy from.

Find the right balance between quality and cost, and don't be afraid to shop from multiple supermarkets.

Consider homemade and discounted gifts

A thoughtful way to save at Christmas is through homemade gifts.

They show that you care after spending time creating them, plus they almost always cost less.

For example, I like to make bottles of foraged blackberry/fruit gin, chutney or jam.

All of these are best made early as they need to mature a bit before Christmas. They cost around £4 to £5 per person.

Scour the second-hand marketplace for gifts on your list, like Gumtree or Vinted. I often see items that look brand new in packaging for sale on these sites/apps.

Also, look out for deals. There is a great app called Idealo where you can set up a price alert for gifts. It keeps watch and tells you when there is a price change.

Oh, and be aware that Black Friday may not be the best time to bag a deal!

Only buy something on Black Friday if it is genuinely something on your Christmas or need list, and check out the previous prices on Idealo to see if it's a good deal.

If you need it, get help

Don't avoid getting help if you're in debt.

If you are in this situation, please reach out to Step Change, Christians Against Poverty and Citizens Advice Bureau.

They are free charities and will help you with the entire process of sorting out that debt, such as Moneyhelper. Your bank can also help.

There is always a way out of financial problems, so please reach out for help if you need it.

Lynn Beattie is a personal finance expert and founder of Mrs Mummypenny. Her background is an ACMA management accountant of 17 years with a breath of experience working in commercial finance for Tesco, EE & HSBC. She is a single mum to three boys, living in Hertfordshire.

She left the corporate world in 2015 to run Mrs Mummypenny full-time. Lynn features regularly on campaigns for PensionBee, Zopa Bank, AMEX and Smart Energy GB. Also featuring regularly in the media including The Financial Times, The Sun, iWeekend and BBC TV/Radio. She presents a weekly Podcast/YouTube series, Mrs Mummypenny Talks. Lynn is the author of 'The Money Guide to Transform Your Life' published 1st Sept 2020.