If you live in a flood zone or a flood is forecast in your area, you may be concerned about flood control and protecting your home. Read on to find tips and advice on preparing for an upcoming flood.

Flooding in the UK

According to the 2024 National Flood Risk Assessment (NaFRA), over 6.3 million properties are at risk of flooding in England alone. In the same assessment, it’s stated that climate change is contributing to increasing flood risk.

The UK Healthy Security Agency’s 2023 HECC report found that the number of people in the UK significantly at risk of flooding is expected to increase because of global warming. Those who are at a significant risk of flooding are expected to increase by 61% by 2050, under a ’modest’ warming scenario of 2°C. In a ’high’ warming scenario of 4°C, this risk is expected to increase by 118% by 2050.

So, not only are there already millions of people living in flood areas in the UK already, but global warming is expected to hugely increase the number of people at risk.

How to prepare for a flood

As an individual, you cannot prevent a natural flood, but you can minimise the damage it does to your home.

Check for flood alerts

Flood alerts are crucial for finding out if a flood is due in your area. Each country in the UK has its own flood alerts page:

- England: GOV.UK’s flood page

- Wales: National Resources Wales page

- Scotland: Scottish Environment Protection Agency page

- Northern Ireland: Northern Ireland Direct page

You can manually check these websites or sign up to phone notifications to alert you of flood risks in your area. The Flood Assist mobile app is also a great tool for receiving real-time flood alerts and is available on Android and iOS.

Make an evacuation plan

While some floods are very minor, others require leaving your home. It’s always best to have an evacuation plan in place so that you know what to do if you need to leave your home.

This plan can include:

- items you need to take with you (e.g., clothes, money, medical supplies, passports, insurance documents, etc.)

- alternative accommodation

- nearby transport links

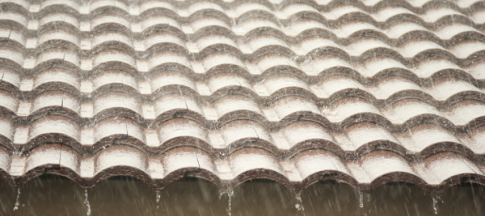

Keep your home’s external drains clear

To reduce the buildup of water around your home, make sure your home’s guttering and outdoor drains remain clear throughout the year.

Check out our guide to cleaning guttering for tips on keeping them clear.

Choose additional flood prevention measures

There are several flood preventions you can use to minimise damage to your home, including:

- sandbags

- permeable driveway paving

- waterproof window and door barriers

- paving your lower stair steps with cement

Check your home insurance policy

If you have home insurance, it’s important to check your policy before and after a flood to see what flood damage you’re covered for.

If you want to claim on your Admiral home insurance after a flood, your excess will apply, and there may be some exclusions. Please check your policy book for more information.

You may also be eligible for Flood Re - you can learn more about this further on.

How to flood-proof your home

If you live in a flood area, you can make your home more flood-resistant to help reduce the amount of damage or loss when a flood does happen.

There are some common home flood defenses you can use to flood-proof your house:

- Keep sandbags: have a stock of sandbags ready to put at doorways if a flood is forecast.

- Varnish wooden skirting boards: this prevents the skirting boards from taking on water.

- Keep valuables sealed: seal expensive or irreplaceable items like home videos and electronics, in waterproof plastic bags and in an upstairs room if a flood is forecast.

- Use air brick covers: these prevent water from entering your home via bricks in the wall.

- Cover your drains and pipes: fitting non-return valves on drains and pipes will stop water from travelling back into your home in a flood.

- Elevate electrics: keep electric appliances (TVs, lamps, etc.) elevated on shelves or countertops to avoid water damage if your home floods.

Do you live in a flood zone?

Some people live in a flood zone but aren’t aware of it. To check if you live in an area at risk of flooding, try using Urban Water’s flood map.

If you do live in a flood zone, make sure you know how to be alerted for flood warnings.

Flood Re and flood prevention

Flood Re is a joint initiative started by the UK government and insurers. Its goal is to make flood cover accessible for those who live in high-risk flood areas. This is done by making flood cover more affordable as part of your home insurance policy.

In 2022, Flood Re launched an additional scheme known as Build Back Better. This scheme also supports people who live in high-risk flood areas. It offers the additional option to install property flood resilience measures that cover costs up to £10,000, with your permission, as part of the repairs.

If your policy has Build Back Better, it will either be on your Home Policy Schedule or you'll have received a letter letting you know about this benefit. If you are unsure if your home policy benefits from this scheme, please get in touch with us.

You can read more about the Build Back Better scheme on the Flood Re website.

Check out our Flood Re explainer article for an in-depth look at how this scheme works.