Buying a home is such an exciting milestone! But it can also come with some confusion and stress, especially if it’s your first time.

Let us make things a little easier by explaining stamp duty and how it works.

What is stamp duty?

Stamp duty (officially known as Stamp Duty Land Tax or SDLT) is a tax that you pay when buying a property in England and Northern Ireland. It’s one of the common costs of moving home.

In Wales, you pay a Land Transaction Tax (LTT) instead, and in Scotland you pay a Land and Buildings Transaction Tax (LBTT).

Who has to pay stamp duty?

Everywhere in the UK except Wales, first-time buyers don’t have to pay stamp duty unless the property they’re buying is worth over a certain value. This can change from country to country.

Otherwise, stamp duty applies to everyone in the UK. But how much you pay depends on the price of the property and where in the UK you live.

Stamp duty rates

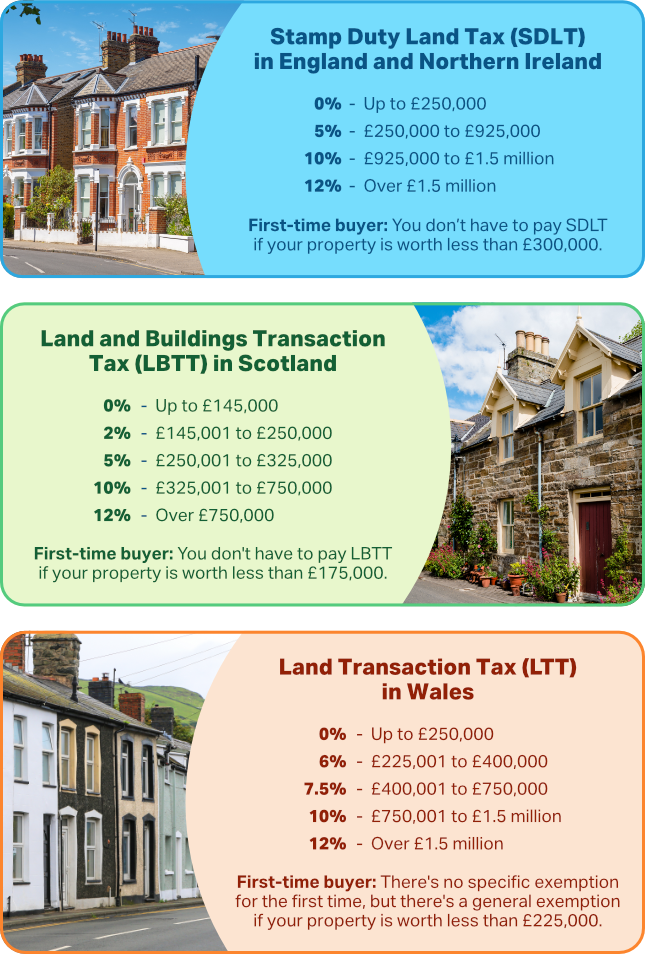

Here's a quick look at the rates for the different countries in the UK.

We've gone into a little more detail below so you can learn more.

England and Northern Ireland

How much stamp duty you pay in England and Northern Ireland depends on how much the house you’re buying is worth:

- Up to £250,000: 0%

- £250,000 to £925,000: 5%

- £925,000 to £1.5 million: 10%

- Over £1.5 million: 12%

So, say you’re buying a house for £350,000. You’d pay 5% of what it’s worth, which is £17,500.

You can also use the HMRC stamp duty calculator on GOV.UK.

If you’re a first-time buyer in England or Northern Ireland, you don’t have to pay stamp duty on a property up to the value of £300,000.

GOV.UK has a handy webpage that delves into stamp duty in more detail if you want to learn even more.

Scotland

How much Land and Buildings Transaction Tax (LBTT) you’ll pay in Scotland depends on how much the house you’re buying is worth:

- Up to £145,000: 0%

- £145,001 to £250,000: 2%

- £250,001 to £325,000: 5%

- £325,001 to £750,000: 10%

- Over £750,000: 12%

If you’re a first-time buyer in Scotland, you won’t have to pay LBTT if your house is worth less than £175,000.

If the property costs more than this, you’re still exempt from paying for the portion of the property that falls under £175,000.

So, say you’re a first-time buyer buying a house worth £380,000. You’d only pay LBTT on £205,000 of it. That’d be taxed at 2%, meaning you’d pay £4,100.

You can learn more about LBTT on the Scottish government webpage.

Wales

Wales replaced SDLT with Land Transaction Tax (LTT) in April 2018.

How much LTT you’ll pay depends on how much the house you’re buying is worth:

- Up to £225,000: 0%

- £225,001 to £400,000: 6%

- £400,001 to £750,000: 7.5%

- £750,001 to £1.5 million: 10%

- Over £1.5 million: 12%

There’s no exemption for first-time buyers in Wales, but you won’t need to pay stamp duty anyway if the home you’re buying is under £225,000.

You can read more about LTT and what it means for you on the Welsh government webpage.

How and when do I pay stamp duty?

Your solicitor usually pays the stamp duty during the property exchange.

It needs to be paid within 14 days of buying and closing on your home.

Do I pay stamp duty when selling a home?

No! But you might have to pay Capital Gains Tax if it’s a second home – in other words, a home you don’t live in permanently.

You’ll have to pay this if the second home you’re selling has increased in value since you bought it.

In some rare cases, you may have to pay Capital Gains Tax when selling your main home.

That’s if you sub-let part of your home or part of your home is registered as a business.

Do I pay stamp duty when buying a second home?

Yes – you'll still need to pay stamp duty when buying a second home. And it’ll likely be at a higher rate than when you bought your main home.

Read more about buying a second home on the GOV.UK webpage.

Do I pay stamp duty on a shared ownership property?

Stamp duty usually applies when you buy a shared ownership property.

Different factors affect how much you pay, including how much of the property you own, the value of the property and whether you’re a first-time buyer.

Head to the GOV.UK webpage on shared ownership stamp duty to learn more.

Do I pay stamp duty on a leasehold property?

Stamp duty for leasehold properties is different to freehold properties.

The amount you pay depends on a few different factors, like if the lease is new or assigned.

Check out the GOV.UK webpage to find out more.

Can I add stamp duty to my mortgage?

You can add stamp duty to your mortgage, but it’s not a super common thing to do.

If you want to add it on, you’ll have to discuss this with your mortgage lender to see if they’ll allow it, as it’ll increase your loan amount.

Can I claim back stamp duty or get a refund?

Yes, it’s possible to get a refund on stamp duty.

You can apply for a stamp duty refund for a few reasons, including if...

- you made a mistake working out the amount of stamp duty needed on your original SDLT return, meaning you’ve overpaid

- you worked out the right amount of stamp duty on your return, but have paid too much to HM Revenue and Customs (HMRC) by mistake

- you paid residential property rates when you should have paid the non-residential rates

- you paid a higher stamp duty rate when buying a new main home, but you’ve sold your previous main home

The official GOV.UK webpage has a full list of refund reasons.

If you live in Wales or Scotland

Don’t forget, all the rules around stamp duty are different in Wales (for LTT) and Scotland (for LBTT).

Make sure you know what these are if you live in either of these countries.

Stamp duty exclusions

You don’t need to pay stamp duty if you’re:

- gifting a home to someone

- changing ownership of a home

- inheriting a home

If you’re a landlord, check out our useful guide to stamp duty for rented and leasehold properties.