From Storm Éowyn to Storm Kathleen, we’ve seen a lot of big storms hit the UK in the past few years. And unfortunately, this type of weather isn’t kind to our homes.

We’ve got some handy advice for how to protect your happy place from a storm and what’s covered by your home insurance.

What’s a storm?

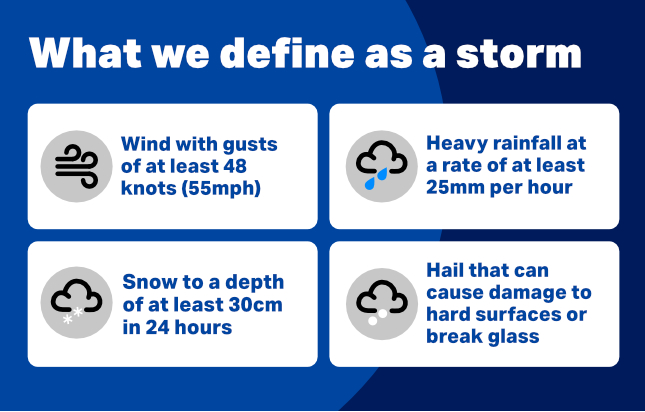

Insurers normally have a specific definition of what they class as a storm.

How to check if a storm is coming

In the UK, we name storms to help alert the public and create awareness.

You can also check any weather warnings issued by the Met Office either on their website or through their X account.

Weather warnings explained

Preparing your home for a storm

So, how do you prepare for a storm? Here are some steps to take to help protect your home.

Check the roof

You should check your roof regularly as part of your general home maintenance.

But after a storm, it’s really important to check your roof for any missing, loose or damaged tiles.

It’s also important to check the flashing on your chimney and roof. This is the rubber or metal plating that waterproofs your roof. You should check the chimney brickwork for damage, too.

If you don’t feel comfortable fixing it yourself, get a professional in.

It’s important to remember your home insurance policy won’t cover damage to your roof that’s caused by general wear and tear.

Keep your gutters free

Blocked gutters and downpipes can cause leaks, damp and even damage to your house’s structure.

That’s because these blockages make rainwater overflow from gutters and pipes and end up where it shouldn’t be.

You can lower the chances of clogged gutters by doing a little bit of housekeeping before the storm:

- remove leaves, sticks and so on from your gutters and ground drains

- check your gutters for any sagging, cracks and similar damage

Find out how to clean your gutters in our guide.

Secure outdoor furniture

Cut the risk of damage to your outdoor items and your home by securing your furniture in advance.

It’s safest to store them in your shed or an outbuilding if you can. Don’t forget other loose items, like rubbish bins, ornaments, plant pots and trampolines.

Read our guide on how to prepare your garden for a storm.

Secure your fence

Most home insurance policies (including ours) don't cover gates, fencing or hedges. That means you won’t be able to make a claim if a storm damages them.

You should:

- fix all panels and fence posts securely in place

- check your gate works and is closed

Read our guide on how to prevent storm damage to fencing.

Clear branches

Branches can easily snap or break off and cause damage during strong winds. Prune any trees close to your home before the storm hits.

You should hire a professional tree surgeon if you have big trees or can't do it yourself.

Check your windows and doors

Have a quick look at your windows and doors to check for any cracked seals, wobbly hinges and other issues.

It’s these little bits of damage that can let water creep in during a storm.

Strong winds can also cause even more damage if your doors or windows aren’t fitted securely.

Close all windows and doors

Close and fasten all windows, skylights and doors to stop rain from getting in.

This also helps stop any panicked pets getting out!

Park your car safely

Park your car in a safe place, like a garage. Avoid parking underneath trees, tiles or anything that can become loose debris in the wind.

This is especially important if flooding is on the forecast! Read our guide on how to prepare for flooding.

Prepare a home emergency kit

We’d suggest putting together a home emergency kit in case there are power cuts or any other emergencies. Keep it somewhere accessible.

It should include:

- a torch

- spare batteries or portable chargers

- a first-aid kit, including any medication that you or your family might need to take

- warm clothes and blankets

- important documents

What to do if a storm damages your home

The most important thing is to stay safe. Follow the local council or the emergency services’ instructions.

If you’re told to leave your home, only head back if you’re told it’s safe.

Get in touch with your insurer as soon as possible to make your claim and get the process started.

Head to our storm weather hub to find out more about what to do during a storm and what to check afterwards.

Does home insurance cover storm damage?

Your home insurance should cover you for damage caused by storms.

Before claiming, make sure you check the criteria in our ‘What we define as a storm’ section earlier on in this guide.

We won’t cover you if the storm doesn’t meet that definition.

Other things we don’t cover include:

- damage from wear and tear, like worn cement in chimneys

- gates, fences and hedges, like gates being blown off their hinges

- poor workmanship or design, like roof tiles that weren’t secured properly

Always check your policy book to see what you are and aren’t covered for to be safe.

If you need to make a claim, head to MyAccount or our make a claim page.

If you want to know a little more about what to expect, head to our guide to home insurance claims.

What's Home Emergency Extra cover?

If you’ve got Home Emergency Extra cover with us, you might be covered for temporary repairs after storm damage.

It can cover you for storm damage to roofs, doors or locks if your home becomes unsecure.

You need to let us know about the issue within 4 days of finding it to be covered. Don’t forget, limits and exclusions apply!

Home Emergency Extra cover is standard on Platinum home insurance policies.

You can add it to our Admiral and Gold levels of home insurance too. Head to our Home Emergency and Home Emergency Extra cover page to learn more.